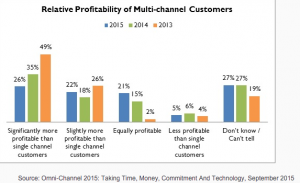

In RSR’s most recent benchmark on retailers’ omni-channel strategies, my colleagues Brian and Paula found the percent of retailers who report that their cross-channel shoppers are their most profitable shoppers is on the decline. Here’s the chart for easy reference:

I’ve seen this chart quoted a couple of times now, incorrectly. So I thought I’d take this opportunity to clarify. While it is true that there is a pretty straight-line decline from 2013 to 2015 in the percent of respondents who report that their multi-channel shoppers are significantly more profitable than single channel shoppers, the conclusion that there is something wrong with omni-channel shoppers is dead wrong. The decline is there, but for very different reasons than the surface-level data might suggest. Digging deeper reveals a many-faceted story.

The first part of the story comes from whether customers who shop in multiple channels are inherently more profitable or not. In the early days of customers who shopped both stores and online, retailers were concerned that these shoppers were more profitable simply because they were more engaged shoppers to begin with. In other words, shopping multiple channels was not the cause of high profitability among this group. It was the effect.

However, retailers with strong loyalty programs soon reported that, the more channels a customer shopped, the more profitable she was. It was causal if you encouraged a customer to shop in a new (to her) channel, she would then over time become a more profitable customer than she would’ve if she’d stuck to her single channel.

This was a fascinating development for retailers’ omni-channel strategies. And it suggests something about the channels themselves that there is some kind of relationship between channels and the ever-elusive “engagement”. For our purposes, I’ll define engagement to mean the willingness of a shopper to continue to be contacted by the retailer (or brand) and to continue exploring that retailer’s content or commerce offerings. The more channels a shopper uses, the more she is likely to “engage” and thus the more she is likely to buy and buy profitably for the retailer, not just cherry-pick the best deals.

Which leads to another important dimension of omni-channel profitability. Online shoppers, in general, are less profitable than store shoppers. Why? Two reasons, one, because online is more fiercely competitive than stores, thanks to easy price transparency and the aggressiveness of online-only competitors, like Amazon, who operate a different cost structure than retailers with stores. Two, online tends to also be the big “clearance store” for retailers, so price points and margins tend to be less than you find in stores.

So when looking at the “multiple channel shopper” measure of profitability, for retailers to say that a shopper in multiple channels is significantly more profitable than one in a single channel is actually really saying something for store-based retailers, because when 90% of your transactions happen in stores, and online has lower price points and tighter margins, then theoretically a multiple-channel shopper should actually be a less profitable shopper as increasing spend online drags down the overall average. The fact that in the early days of this measure, retailers were saying that multiple-channel shoppers were significantly more profitable than a single channel shopper that was actually a big deal.

Which leads us back to the chart above. Part of the reason why multiple-channel shoppers are no longer significantly more profitable than single-channel shoppers is because the ratio of multi-channel to single-channel shoppers is falling. For most retailers the multi-channel shopper is no longer the exception, she is the rule. Anecdotally, we hear that more shoppers are multi-channel shoppers than single-channel shoppers. When the comparison (multi-channel shoppers) gets larger than the base (single channel shoppers) the difference between the two becomes less compelling. Multiple channel shoppers are the norm, and single channel shoppers have become the exception and a less interesting exception than multi-channel shoppers were back in the day.

That covers that data point. But what about the rest of the chart? In fact, the most important data point on the chart above is not actually the decline in retailers reporting that multi-channel shoppers are more profitable. It is at the opposite end of the chart where 27% of respondents in 2015 reported that they can’t tell or don’t know if there is a profitability difference at all. In 2013, that number dipped (19%), but that was actually an outlier, even from earlier years. The percent of respondents reporting that they don’t know, has stayed pretty consistently at about one-quarter for years, almost for as long as we’ve been running this particular benchmark.

This is very worrisome for retailers. If more and more shoppers are becoming cross-channel shoppers, and retailers have no idea if those shoppers are more or less profitable than anyone else (most likely because they can’t measure customer activity across channels), they’re conducting their omni-channel strategy from a very bad place, a place of dangerous ignorance. How do they know if their investments are working? What are they measuring to understand if those investments are meeting customer needs as they try to cross channels?

To be fair, customer profitability is not the only measure out there. But it’s a good indicator of the retailer’s omni-channel maturity if they can (or can’t) tell you customer profitability by channel.

I fully expect to see the day when retailers report that cross-channel shoppers are no more or less profitable than any other shopper, primarily because there is no longer any real group of single-channel shoppers worth tracking. I hear technology vendors groping toward that future, in their efforts to ditch “omni-channel” and talk about “just retailing.” When cross-channel shoppers are no longer more profitable, then I’m pretty sure that day will have arrived: just retail.