Executive Summary

Whether intentional or not, every business already has a “customer experience”.

The question remains though, are those customer experiences the right ones to maximise the return on investment?

This paper concludes that, while short-term profitability can be found at the expense of a good customer experience, there is clear evidence to prove that the better the experience, the better the return. Customer experiences and returns on investment will, however, mean different things to different companies.

The basic premise is that commercial growth is more likely to happen in a sustainable way if investment is directed to address the right priorities. That not only includes looking outwards to the future and delivering new initiatives but also looking inwards to fix hidden and unintentional issues that cause additional or duplicated work at best and disenfranchised customers at worst.

Talking about emotions in a financial context to metric-driven peers is often challenging for the people charged with leading the customer agenda. And yet the reality is that what dictates whether or not customers buy again, buy more and what they say to others is based on their memory of what it felt like to do business last time.

For better or worse, therefore, the customer experience creates a direct link to the commercial fortunes of a business.

In its simplest form, our ROI – return on investment – will be the answer to “What do I get for my money?”. Forecasting the performance of one investment option against another makes for more effective decision making about what to spend money on and where to allocate resources.

What this report shows though, is that the real return on investment will go way beyond the predicted changes in sales, revenue and cost-savings.

The most significant return we see on an investment in customer experience is harder to quantify than an uplift in sales yet has much more impact. It is the change in mindset to do more of the right things, the increase in employee pride for doing a better job and the strengthening of a brand that customers want, literally, to buy into.

ROI: Money in the bank or smiley happy people?

As we’ll see in the next section, there is no shortage of unequivocal evidence that organisations who have more robust approaches to their customer experience programmes fare better commercially. They outperform their peers on the stock-market, they enjoy higher rates of loyalty and customer metric benchmarking always brings them out at or near the top.

But before we go any further, we can’t ignore those who dismiss the notion of customers having an experience as being the latest fashionable, fluffy thing from Marketing. “We need to make money, not smiley happy people” they will say, swiftly followed by “We’re doing alright as we are, thank you very much”.

We can’t ignore them for two key reasons;; they may well be the decision-makers in the organisation and – to a degree – they have a point. There are, after all, many companies who are making money, getting a good return on capital they’ve invested, but whose customers are not happy. So why change things?

Several reasons.

The customers are new ones each time.

- They are not repeat buyers so not only is there an expense of recruiting new customers but they also take more time and effort to bring on board and get them used to how things work or where they are

It is very rare these days for customers to have no alternative

- Customers have a choice and in their mind already have an expectation of how it should be to do business. Their expectations are created by dealing with people and companies throughout their busy day so they will compare slow airport security queues with how their local supermarket tackles the problem and a clunky hotel booking system with online retailing.

Photo courtesy of Polycart

Photo courtesy of Polycart

Market forces are often cited as the most effective form of regulation and there are very few markets now where customers are not able to exercise their right to choose an alternative, even if the company thinks differently.

Train operators, for example, are regularly criticised for inverse relationship between price changes and the quality of their service. However, they appear reluctant to invest in what are now basic expectations – more seats and free wi-fi – because they operate by a franchise model that has little direct competition. To have a plethora of confusing pricing options with super-standard-on/off-peak framework might put more P in the P&L this week but when the franchise pitch renewal takes place, there will be little support in the way of customer advocacy, while many have already switched to driving, getting the bus or using video-conferencing.

Law firms have trodden the same path. The approach to milk it today because we might not have it tomorrow becomes a self-fulfilling prophecy. Charging by the hour, getting para-legals to carry out the work instead of the promised senior partner, uninformative bills and a lack of responsiveness might all seem unimportant from an internal revenue perspective. But their General Counsel client won’t want to try and justify that to their procurement team let alone their CEO, so come the contract renewal negotiations or a request for a testimonial, the short-sightedness will back-fire.

Winners or losers?

When it comes to sport and fitness, there are winners – those who make sacrifices, put in the hard work and have the right mental approach – and there are losers – the ones who read the books, thrive on platitudes and then wonder why they are losing ground.

It’s the same with the health of a business. The gulf between the organisations who change the way they operate to be more in line with the way their customers think and those who “do it the way we’ve always done” is widening.

Bain & Co’s assessment of the airline, grocery, telecoms and retail industries showed a direct correlation between compounded annual growth rates and net promoter scores.Those companies who led the growth rates also had the highest NPS results, and vice versa.

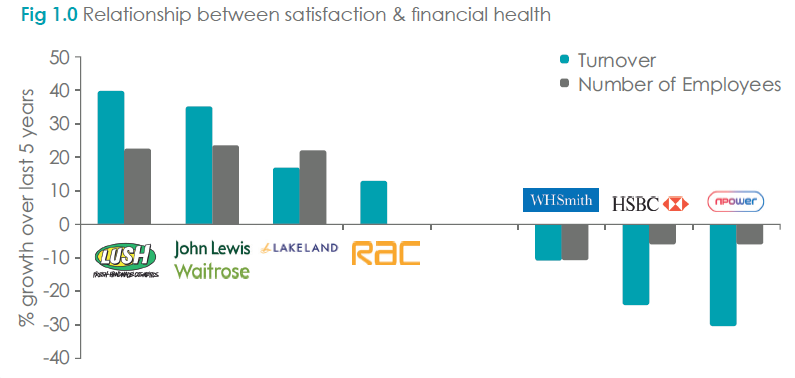

In order to understand more deeply the correlation between customer opinions and commercial performance, we at Custerian undertook a further piece of research.

We looked at the organisations who regularly topped the ratings of customer surveys by the likes of Which? and TrustPilot and mapped that against two key indicators of company health and economic contribution; the relative changes in turnover and headcount over the last five years. The results provide clear findings:

In the group of companies topping the customer charts, cosmetics retailer Lush has seen its turnover rise nearly 40% over the last five years. In January this year, it bucked the flat retail trend by announcing an increase in like for like pre-Christmas sales of over 12% and arise in online sales of 28%.

Both entities in the John Lewis Partnership (JLP) – department store John Lewis and supermarket Waitrose – consistently earn their badges as customers’ favourites. While the Co-Operative proves that a mutual model doesn’t always work, JLP’s autonomy from shareholders allows it to make its own longer-term investment decisions in stores and online retailing.

Both entities in the John Lewis Partnership (JLP) – department store John Lewis and supermarket Waitrose – consistently earn their badges as customers’ favourites. While the Co-Operative proves that a mutual model doesn’t always work, JLP’s autonomy from shareholders allows it to make its own longer-term investment decisions in stores and online retailing.

Crucially though, it knows how important it is to have motivated employees with a vested interest in how well the company does. A poor performance in front of a customer will have a direct impact on their own pocket; the financial performance in 2013 was not up to the levels of 2012 yet the company was still able to give its employees a15% bonus.

![]() Another retailer reaping the benefits of good customer experiences is kitchenware and homeware specialist Lakeland. Their sharp focus on continual innovation and in providing a high level of service that their customers eulogise about to friends are key reasons why turnover and employee numbers have outperformed many others in the retail sector.

Another retailer reaping the benefits of good customer experiences is kitchenware and homeware specialist Lakeland. Their sharp focus on continual innovation and in providing a high level of service that their customers eulogise about to friends are key reasons why turnover and employee numbers have outperformed many others in the retail sector.

Meanwhile the RAC has enjoyed the benefits maintaining its advocacy scores above 80. The investment in roadside technology, breakdown patrols who are capturing real-time customer feedback and the brand positioning of motorists’ champion have all helped to increase sales of nonbreakdown products such as insurance and other financial products.

Meanwhile the RAC has enjoyed the benefits maintaining its advocacy scores above 80. The investment in roadside technology, breakdown patrols who are capturing real-time customer feedback and the brand positioning of motorists’ champion have all helped to increase sales of nonbreakdown products such as insurance and other financial products.

The double-whammy of having the right customer experiences is seen not only in the financial reporting of those companies, but they are raising the bar of minimum expectations that customers want to see from their competitors and other organisations in general. How many times have you heard a company say it wants to be known as the first direct of its own market?

The organisations in our research who languish at the foot of several consumer reviews include retailer WH Smith, retail banking giant HSBC and energy company npower. In the same period they all saw turnover fall and shed employees.

In recent years, WHSmith has responded to accusations of being out of touch with lacklustre stores and uninspiring product ranges though it has been a long road. Sales over the Christmas 2013 period were down some 6% on the previous year. Offsetting that decline, profitability has been protected by cutting costs and hopes are pinned on new outlets at airports, developing the international presence and taking advantage of its Post Office implants .

In recent years, WHSmith has responded to accusations of being out of touch with lacklustre stores and uninspiring product ranges though it has been a long road. Sales over the Christmas 2013 period were down some 6% on the previous year. Offsetting that decline, profitability has been protected by cutting costs and hopes are pinned on new outlets at airports, developing the international presence and taking advantage of its Post Office implants .

Meanwhile, few banks have escaped from the consequences of the financial crisis. The reputation of HSBC has been tarred with the same brush, though ironically didn’t need financial support from the UK government at the height of the crisis. Its flaws appear to stem from (perhaps unintentionally) making things difficult for customers to carry out basic transactions or enquiries. Making things worse, within its own camp it has firstdirect, a retail bank that always gets people evangelising about at dinner parties and workshops.

Meanwhile, few banks have escaped from the consequences of the financial crisis. The reputation of HSBC has been tarred with the same brush, though ironically didn’t need financial support from the UK government at the height of the crisis. Its flaws appear to stem from (perhaps unintentionally) making things difficult for customers to carry out basic transactions or enquiries. Making things worse, within its own camp it has firstdirect, a retail bank that always gets people evangelising about at dinner parties and workshops.

![Npower]](http://thehive.hivemindnetwork.com/wp-content/uploads/sites/2/2014/08/Npower-300x116.png) Finally in this brief selection, RWE npower. On the face of it, a very warm, welcoming organisation with some great people wanting to do a good job. But, like the banks, when it comes to what should straightforward interactions, the rushed and rigid processes, flawed systems and metric obsessions all get in the way. Between July and September 2013, npower had eight times as many complaints per 100,000 customers as the best performing energy company. With the majority of customers not bothering to complain these days – they just take their business elsewhere – the impact is significant, to say nothing of the costs of handling complaints and of the rework caused by unsolved issues and broken promises.

Finally in this brief selection, RWE npower. On the face of it, a very warm, welcoming organisation with some great people wanting to do a good job. But, like the banks, when it comes to what should straightforward interactions, the rushed and rigid processes, flawed systems and metric obsessions all get in the way. Between July and September 2013, npower had eight times as many complaints per 100,000 customers as the best performing energy company. With the majority of customers not bothering to complain these days – they just take their business elsewhere – the impact is significant, to say nothing of the costs of handling complaints and of the rework caused by unsolved issues and broken promises.

ROI vs CNI (the Cost of No Investment)

Inherently, as human beings we see change and the creation of something new, doing things a different way, as risky. So the argument goes, if it doesn’t exist today how do we know it’ll work tomorrow. And so the Business Case was born.

Looking at things the other way around though is easier to comprehend and deal with. If we’re shown evidence that the way we do things today are damaging our business then why wouldn’t we want to stop that?

That’s one of the powerful, commercial benefits of using Customer Experience as a way of thinking; thinking the way our customers do.

Whether it’s forensic journey mapping, a workshop for employees or a customer diary, knowing what it’s really like to do business with us gives us those all important quick-wins and confidence to invest time, money and resource in the right places for bigger issues.

While fixing problematical process that cause niggles and gripes doesn’t have the shiny appeal of an exciting new project, it can have every bit – if not more – impact on the bottom line as Temkin Group recently noted.

Their findings from a study based on 10,000 consumers of 268 companies in 19 different industries showed that after a bad experience, up to 61% of consumers cut back on their spending with that company; when companies provide a very poor response to complaints, 62% will cut back on their spending and only 2% will increase what they buy. When companies provide a very good response, only 21% decrease their spending and 29% increase their spending.

In our own work with clients we see examples where customer queries are not resolved properly because the agent is rushing to ensure the works fits a call-handling metric. Consequently, the call back from a customer creates additional unnecessary rework, high degrees of frustration and potentially a loss of business.

Similarly, the money invested in a new Marketing campaign that promises “we put you at the heart of everything we do” will be wasted if the customer then calls, has to negotiate an IVR then is put on hold and eventually greeted with “Hello, can I have your account number please?”.

Many airlines have invested in creating an app that will track a passenger’s lost bags and the expense is counter-intuitive on many levels. Passengers much prefer to assume their bags will travel with them on the same aircraft; if bags get lost they’d rather someone found them to explain what the options are; and usually it is the airport baggage handlers that manage that process and not the airlines. Technology is great, but spending money on it for technology’s sake and something that adds little in the way of value to a customer is not likely to generate a good return on investment.

Customers don’t see lack of investment as a political merry-go-round of internal budget setting and organisational politics; they see it as being apathetic towards making their life easy; over promising and spectacularly under-delivering.

They have an experience. And a memory. And a choice.

The real return on investment

One less-talked about benefit – or “return” – of having a focus on customer experience is the change in organisational culture and in the mindset of individuals. It’s a change that has to have been made to ensure the financial and commercial returns are as good as they can be. It’s a change that becomes infectious, a positive upward spiral. It is a return that is hard to quantify in the annual accounts yet the absence of it is a (sometimes unintentional) lethargy that plays directly into the hands of competitors who are bringing about the right changes.

Having a mindset and culture to stop investment in things that customers don’t value is invaluable. Knowing what they do value and how that can be translated into financial results and the achievement of objectives in stakeholders’ performance scorecards is equally so.

In the right hands then, the customer experience way of thinking will keep activity prioritised and in perspective. Creating “Wow!” moments might sound good but if the basics are not in place and keeping pace with rising expectations, Wow can easily become an acronym for waste of work.

Likewise, benchmarking against competitors is always a favourite exercise and understandably so. However, that’s not how customers benchmark organisations. They will take the best and worst of their experiences from going about their daily lives, irrespective of industry, channel or product.